-

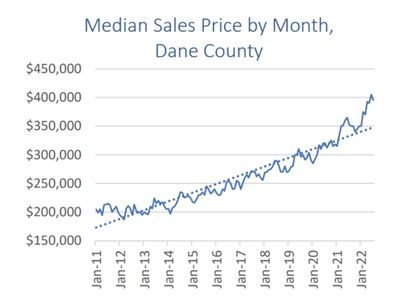

Labor day is upon us, summer is at an end. We hope that you had a wonderful summer. Traditionally there has been a slow down in the market after a busy spring market. We often go into the fall with renewed market activity. So how does this year compare? Are we seeing a bubble? Or a buyers

Read More

Recent Posts

Do I Need a Home Inspection in Madison, Wisconsin? Weighing the Pros and Cons

Tactics for home inspection in a seller's market

Celebrate Dad in Style: Fun Father's Day Ideas in Madison, Wisconsin

Spruce Up to Sell Up: Home Improvements That Boost Your Property Value for a quick sale

Finding Affordable Homes in Madison, Wisconsin

5 Reasons to Invest in Your Future: Buy a Home This Year!

Why You Need a Real Estate Pro on Your Team: Guide to Conquering the Market

Furry Friends, New digs: A Guide to Moving With Pets

Wednesday at Capitol View Farmers' Market and Richmond Hill Neighborhood Garage Sale

Demystifying the Process: Top Questions to Ask Your Estate Agent